Every rental property owner faces the decision of choosing between short-term rentals (like Airbnb) and long-term leases. Each strategy has unique advantages and challenges, and the most profitable option depends on several factors, including location, market demand, and management requirements. This article explores the key differences and profitability potential of both options in 2025.

What’s the Difference Between Airbnb and Long-Term Rentals?

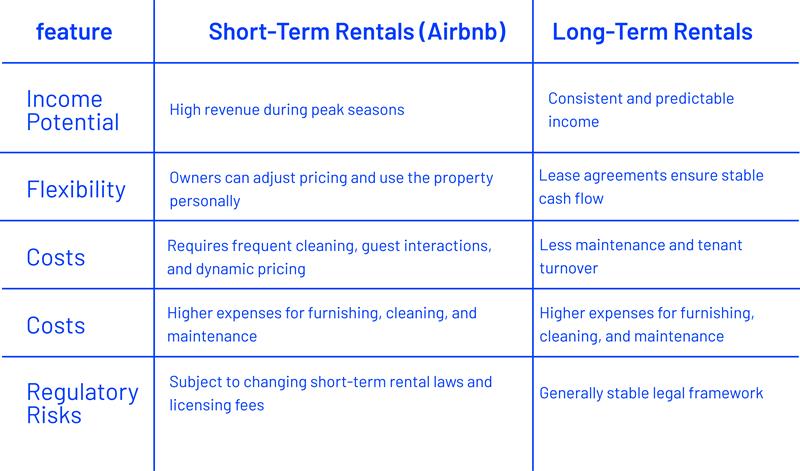

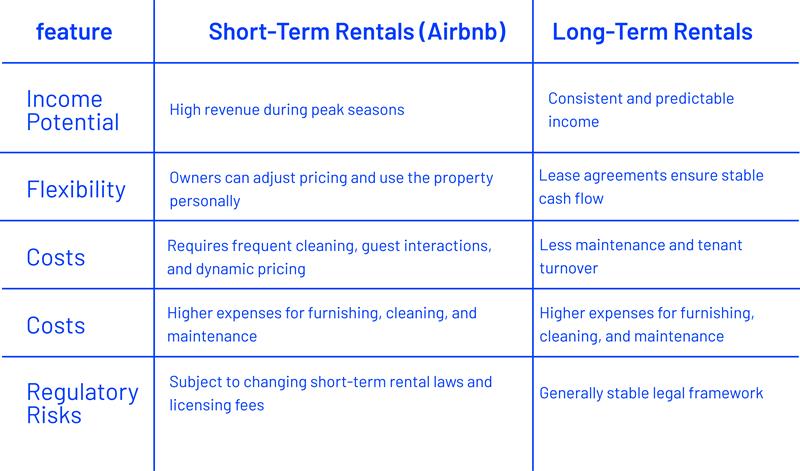

The primary distinctions between short-term rentals and long-term leases lie in rental duration, income potential, and management efforts:

Rental Duration: Airbnb and other short-term rentals accommodate stays ranging from a few days to a few weeks, while long-term rentals involve lease agreements lasting months or years.

Income & Flexibility: Short-term rentals can generate higher nightly rates and allow pricing adjustments based on demand. Long-term rentals offer steady income but typically lower yields.

Management & Maintenance: Short-term rentals require frequent cleaning, guest communication, and maintenance, whereas long-term leases demand less daily oversight.

Pros and Cons of Each Strategy

Factors Influencing Profitability: Airbnb vs. Long-Term Rentals

1. Location & Demand

Short-Term Rentals: Properties in tourist hotspots, near attractions, or in high-demand urban areas tend to perform well as short-term rentals. People searching for “short term rentals near me” or “short term apartment rentals near me” indicate a strong local demand.

Long-Term Rentals: Residential areas near business districts, schools, and transit hubs are ideal for stable tenant occupancy.

2. Income & Occupancy Trends

Short-Term Rentals: Short-term rental market data suggests that Airbnb hosts can earn significantly higher profits during peak seasons. However, occupancy may fluctuate in off-seasons.

Long-Term Rentals: Provide consistent monthly cash flow, reducing the risk of vacant periods.

3. Expenses & Maintenance

Short-Term Rentals: Higher expenses for furnishing, cleaning, and utilities. Platforms like Pulsereal provide free short-term rental data to help optimize operational costs.

Long-Term Rentals: Tenants usually cover utilities, and management efforts are lower.

4. Regulations & Taxes

Short-Term Rentals: Many cities are tightening short-term rental laws. Investors must check local policies before committing.

Long-Term Rentals: More straightforward taxation and fewer regulatory hurdles.

Which Rental Strategy is Right for You?

If your property is in a high-tourist area and you can handle frequent management tasks, short-term rentals may yield a better ROI. However, if you prefer stability and passive income, long-term rentals are a safer bet.

To make an informed decision, short-term rental data analysis is essential. Platforms like Pulsereal provide short-term rental data insights to help investors maximize profitability and navigate market trends in 2025.